A List of Top 15 Investors Investing in Canadian Healthtech Startups

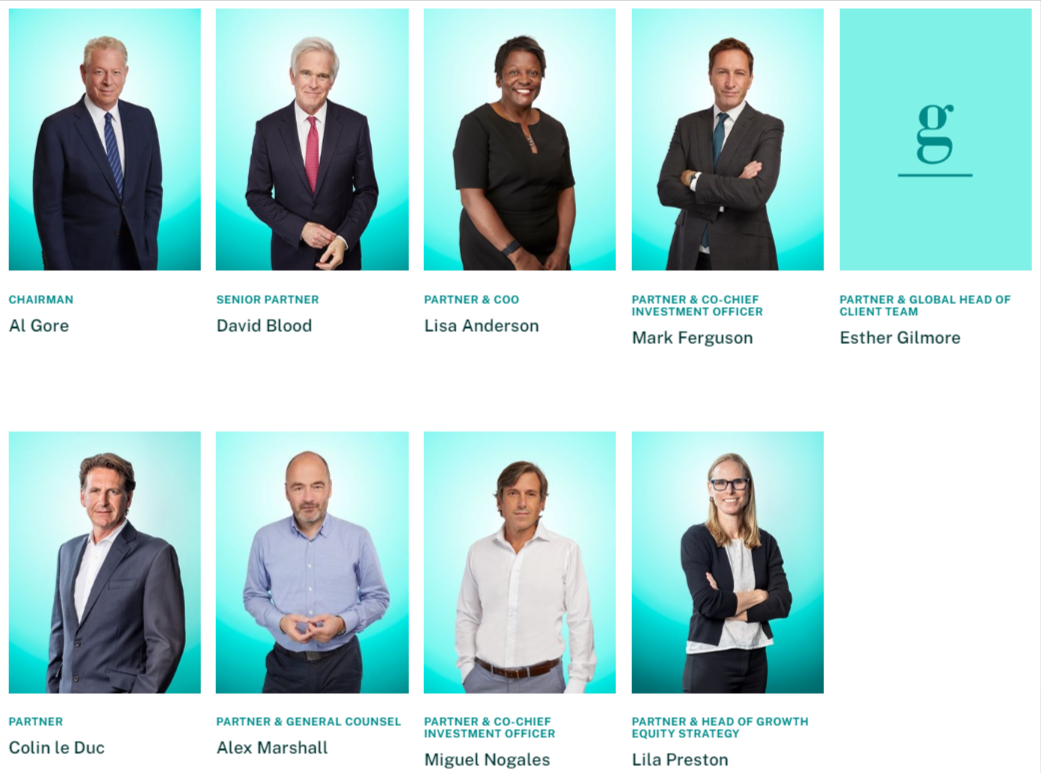

1. Generation Investment Management

Based in London, UK, and founded by AI Gore and David Blood, they have been investing sustainably in the environmental, social, governance, and healthcare sectors.

They were the lead investor in AlayaCare’s series D financial round, announced on June 23, 2021.

So far, they have made 59 investments.

The following is its leadership.

2. Inovia Capital

Inovia Capital is Canada’s one of top investors – based in Montreal.

They have invested in more than 47 startups including pioneering healthcare startups such as AlayaCare, BenchSci, Forward, and Future Family.

Inovia Capital helps startups from seed, through IPO and beyond.

3. Caisse de Dépôt et Placement du Québec (CDPQ)

Another Canadian investor recently invested a whopping $400,000,000 in Celsius Network.

CAPQ has invested in more than 65 countries and has an asset worth $389 billion.

Out of their all investments, they have invested almost 32% in Canadian startups.

They have invested in top healthcare startups like AlayaCare, and PharmEasy.

Our colleagues leverage their talent and leadership, both in Québec and abroad, to drive our activities in the finance and investment sectors. Together, we contribute to building a more sustainable future. #InternationalWomensDay pic.twitter.com/jkWPyRPloC

— CDPQ (@LaCDPQ) March 8, 2022

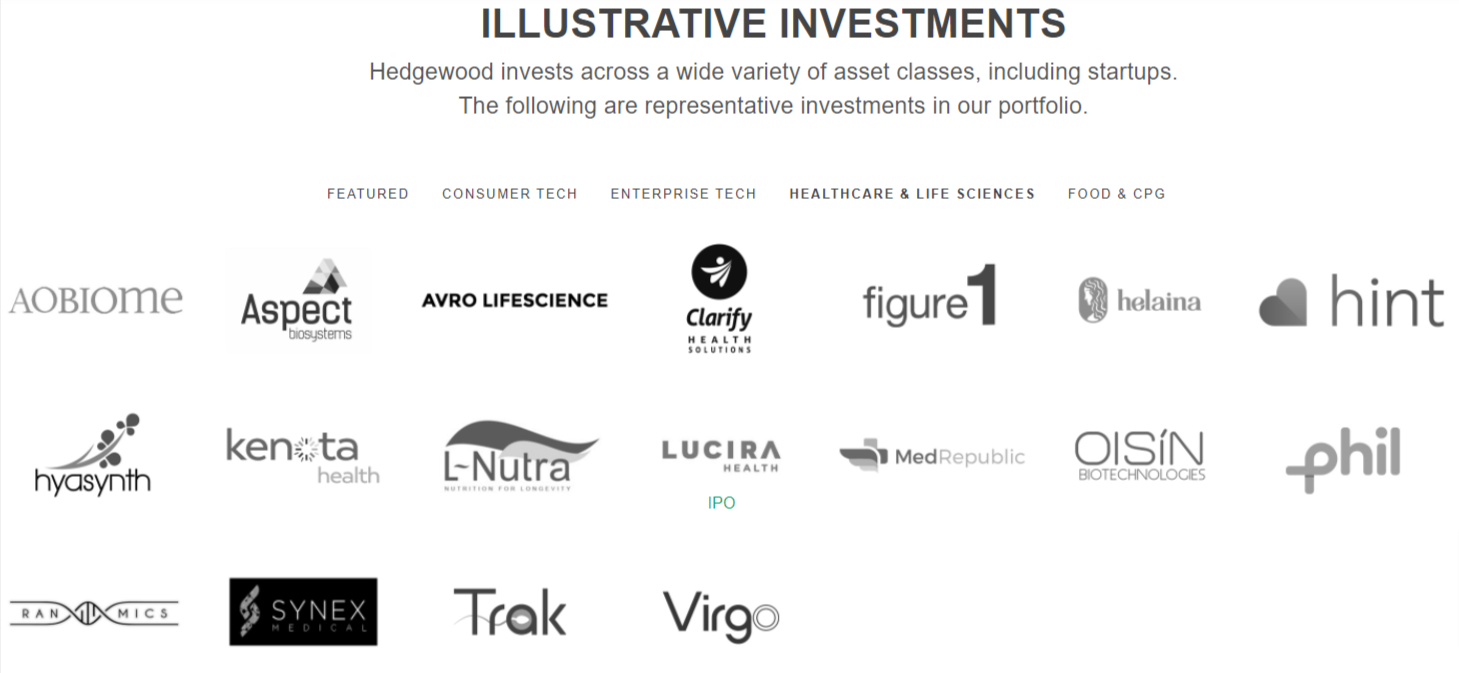

4. Hedgewood

Hedgewood is a Toronto-based investment firm, making value-oriented investments.

Their types of investments include Debt, Early Stage Venture, Late Stage Venture, Private Equity, Secondary Market, and Seed.

So far, they have made a total of 118 investments.

Talking specifically about their health tech portfolio, Hedgewood has invested in some of the very game-changing health tech startups like AlayaCare, CareGuide, Clarify Health Solutions, Figure1, Geologic, Greatist, Lucira Health, Phil, etc.

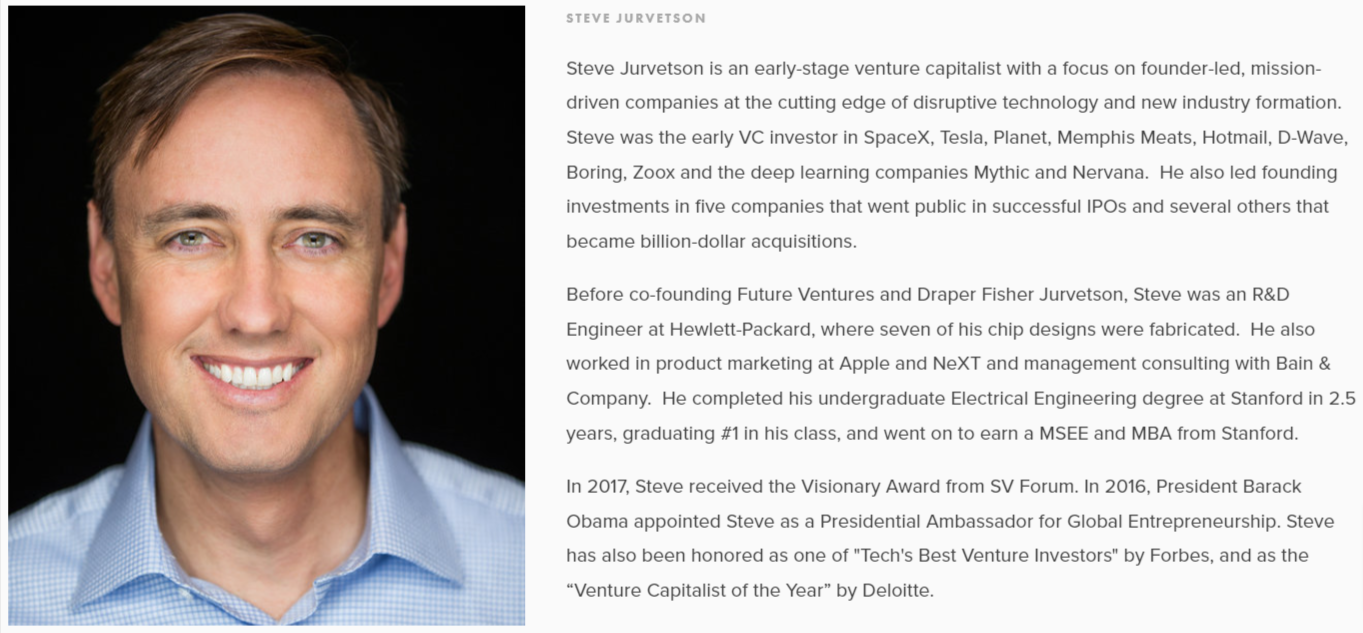

5. Future Ventures

Future Ventures is a San Francisco-based early-stage venture capital fund.

They have made investments 21 times in some of the top startups & companies such as SpaceX, The Boring Company, Tesla, and Skype.

As far as their health tech portfolio is concerned, it includes Sutro Biopharma, Prellis Biologics, Medcorder, Faeth, Deep Genomics, Atai Life Sciences, etc.

6. Khosla Ventures

Based in California, Khosla Ventures majorly invests in the internet, computing, mobile, silicon technology, biotechnology, healthcare, and clean technology sectors.

So far, they have made over 950 investments and raised over $2.9 billion.

Out of their 950 investment rounds, they led over 350 investment rounds.

They have invested in several health tech startups such as AliveCor, Apton Biosystems, Arpeggio Bio, BIOAGE, Caption Health, CareSwitch, Carrot, Deep Genomics, DiscernDx, Earli, eGenesis, etc.

You can check out their entire health tech portfolio from here.

7. True Ventures

Based in Palo Alto, True Ventures has made a total of 581 investments worth over $2 billion.

It is a venture capital firm and majorly invests in early-stage tech startups.

Talking about their healthtech portfolio, they have made investments in Framework, Voi, Health Gorilla, Gyroscope, Lumity, Riva, Less, Zero, Pendulum and Deep Genomics.

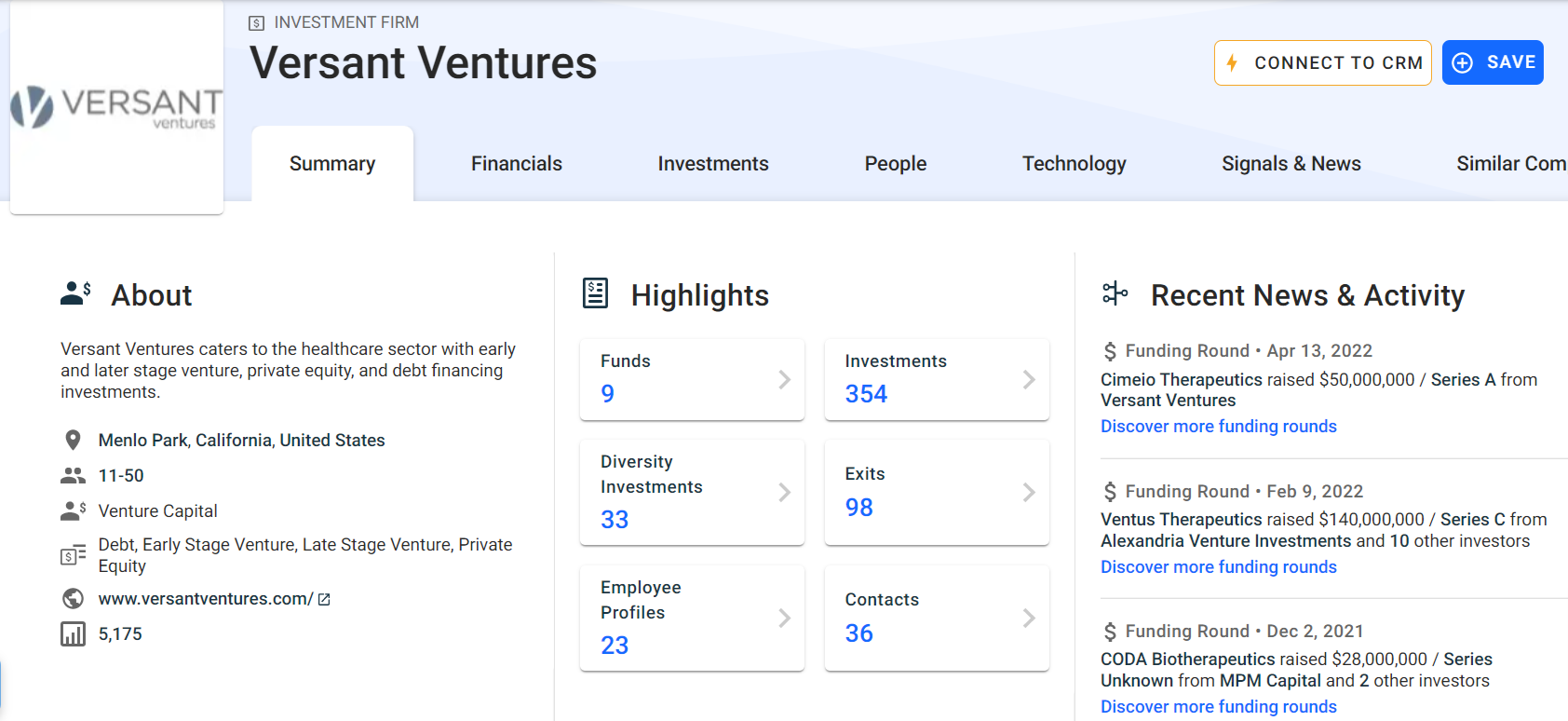

8. Versant Ventures

Versant Ventures is one of the few investors who primarily invests in health tech startups only.

They have made over 349 investments and have over $4 billion under management.

Their portfolio majorly includes health tech startups and companies such as AlterG, Anokion, Bright Peak Therapeutics, Capsida, Coda, BlueRock Therapeutics, Monteris Medical, Veran Medical Technologies, etc.

9. Acton Capital

Based in Germany, Acton Capital has been active in the market since 1999.

Recently, they invested in Hublo which is an HR management tool for healthcare institutions in Europe.

So far, they have made over 150 successful investments.

Their most existing investment for the Canadian health tech market is in Maple – a top telemedicine platform in Canada.

In Maple, Acton Capital has invested over CA$14.5M.

10. RTW Investments

RTW Investments is another healthcare-specific investment firm that majorly invests in innovative healthtech startups and companies.

They have made over 56 investments and their most recent investment was in CinCor Pharma.

RTW Investments is always ready to invest in healthcare startups easing treatment of top diseases such as cancer, Neurology, CVD.

Their portfolio includes some of the very innovative healthtech startups such as Armo Bioscience, Arvita, Athira Pharma, Biomea Fusion, DermTech, Milestone Pharmaceuticals, etc.

11. Pura Vida Investments

Pura Vida Investments is a New York-based healthcare-focused investment firm that majorly invests in healthtech startups for a better tomorrow.

They have made almost 19 successful investments including an investment worth $30 million in a Canadian healthcare company named MedAvail.

Their healthtech portfolio includes some of the very well-known and innovative startups such as Atai Life Sciences, Caris Life Sciences, Cathworks, Claret Medical, Exo, Genalyte, Vizgen, Willow, etc.

12. Lewis & Clark Ventures

Lewis & Clark Ventures is a Missouri-based venture capital firm that invests in series A stage companies.

They have made over 32 successful investments in Canadian and American startups. Most recently, they have invested in Tomo Credit.

Talking about their healthcare portfolio, they have invested in Kaizen Health, Beam, Adarza and Medavail.

13. Telus Ventures

Based in Vancouver, Telus Ventures is run by Telus, a North American telecommunications company.

So far they have made 128 medium to large scale investments.

They majorly invest in early-stage companies, late-stage companies, and seed rounds. Their investment priorities are ag-tech, connected consumer, digital health, and IoT sectors.

Their healthcare portfolio includes Acorn, Bindle, GenXys, League, PocketPills, Recovery One, etc.

14. WaterBridge Ventures

WaterBridge Ventures is an early-stage venture capital firm – based in New Delhi, India.

Though it was founded fairly recently – in 2016, WaterBridge Ventures has made over 42 successful investments.

They have also made investments in several healthtech startups such as EloElo, LetsMD, Nymble, MedCords and PocketPills.

15. Kensington Capital Partners

Founded in 1996, Kensington Capital Partners is a Toronto-based investment firm.

They have made a total of 63 investments, including a whopping $10 million in the Series B funding round of Figure 1.

Their healthtech portfolio includes top Canadian healthtech startups like Figure 1 and LifeSpeak.

Toronto-based pet tech startup @Vetster has secured $37.8M CAD from @KensingtonFunds to keep expanding into new markets. https://t.co/jAZF7bon2e

— Ontario Innovation (@OntInnovation) April 20, 2022